Everything You Need To Know About Roth IRAs

Think it’s too early to start thinking about retirement? Think again.

With the increasingly uncertain fate of Social Security and the shift away from corporate pension plans, our financial foundation in retirement is becoming increasingly dependent on our decisions as individuals.

That’s a lot of pressure, especially for young people. But if you start preparing while you’re still young, it’s going to take a lot less money to get you to a safe and secure retirement with over $1 million. This is because of compound interest.

Albert Einstein supposedly declared compound interest “the eighth wonder of the world” and for good reason. Compound interest refers to the concept of your interest accruing interest and is one of the strongest forces at play in investing.

To put it into practice, if you invested $100 into an account that paid you 10% interest every year, after one year you would have earned $10 in interest ($100*10% = $10) and your balance would be $110. However after a second year you would have earned another $11 in interest ($110*10% = $11) and your balance would be $121.

That $1 in additional interest from year one to year two is the result of compound interest.

Now while that might not seem worthy of they kind of applause that Einstein gave, when you take this phenomena and expand it to a larger scale it becomes much easier to see where he was coming from.

The two primary ingredients of compound interest are time and money (and don’t worry we will be getting to how all of this translates into you retiring a millionaire). When you add more of either of these ingredients, the effect of compound interest is magnified.

Coming back to out $100 example, if instead of 2 years you would have let that $100 grow for 20 years you would have ended up with $672.75 (that’s almost 7x what you stared with!)

On the other hand if you started with $10,000 instead of $100, that $21 in interest becomes $2,100 in interest in just 2 years.

So now you’ve got the first piece of the puzzle to retiring a millionaire down: compound interest. But there is one other thing that you’ll need to utilize along with compound interest in order to follow the $5 a day strategy to wind up with a seven figure retirement: a Roth IRA.

What is a Roth IRA?

A Roth IRA is a tax-advantaged retirement savings account that allows you to prepare for retirement while taking advantage of a host of benefits that can end up saving you a significant amount of money.

The money that you put into a Roth IRA is income that you have already paid taxes on, and the primary benefit to this type of account is that the money that you withdraw from the account is tax-free.

This is different from your traditional brokerage account where you will deposit income that you have already paid taxes on and end up paying taxes again on the capital gains of your account when you sell.

Currently the majority of Americans fall in the 15% tax bracket for capital gains. This means that if you had $1,000,000 in capital gains in a traditional brokerage account, you’d owe $150,000 in taxes!

With a Roth IRA you would owe $0 on those capital gains and allow yourself a much more secure retirement without having to worry about a significant tax bill when you realize your gains.

What are the Restrictions?

Clearly the tax-free gains you can earn in a Roth IRA make it a highly beneficial tool for individuals looking to secure a safe retirement. However this type of account does have three important restrictions that are important to keep in mind.

If the government is providing an avenue for you to pay less in taxes, you can bet they have some pretty strict rules and regulations about what you can and cannot do.

Restriction #1 Yearly Contribution Limit

The first major restriction that a Roth IRA presents is the yearly contribution limit. As of 2020, the yearly contribution limit to a Roth IRA is $6,000 (or $7,000 if you are 50 or older). This means that after you have deposited $6,000 into your Roth IRA, you will not be allowed to make another deposit until 2021.

Any additional capital you wanted to invest would need to be deposited into a traditional brokerage account or investing app and would not receive the same tax-advantaged treatment of a Roth IRA.

Restriction #2 You Cannot Withdraw Your Gains

Potentially the most significant restriction of Roth IRAs is that you are not allowed to withdraw any of your gains until the age of 5912. If you withdraw any of your earnings (the gains beyond your deposits) the distribution you take will be taxed as ordinary income and a 10% penalty my be applied.

This means that the average American would end up paying about 32% in taxes for any early withdraw and is definitely not something that you want to be doing if you don’t have to.

A common misconception that many people have about Roth IRAs is that this restriction means that they are not able to withdraw any of the money they put in the account until they are 5912. This is not the case.

This rule only applies to earnings and you are free to withdraw any deposits that you have made into your Roth IRA at any point without taxes or penalty.

Restriction #3 If You Make Too Much Money You Cannot Contribute

The final major restriction of Roth IRAs is that once you move beyond a certain income threshold you are no longer eligible to make deposits into your Roth IRA.

In 2020 if you make more than $139,000 as a single person or $206,000 as a married couple, you are not eligible to contribute to a Roth IRA.

This income cap is another reason why Roth IRAs are great for young people. When you are 18 you are likely not making over $139,000 per year and are perfectly free to contribute to a Roth IRA and start building your foundation for retirement early on.

The $5-a-Day Strategy

Now that you understand compound interest and Roth IRAs, we can combine both of these financial concepts to create the $5-a-day strategy. As the name suggests, following this strategy requires only $5-a-day and when applied historically, you would have become a millionaire had you applied this strategy over any 50 year time frame.

Now before you lose interest in this strategy after hearing the timeline required to achieve it, remember the two ingredients of compound interest: time and money.

The $5 a day strategy relies more heavily on the time side of the equation in order to make it more accessible to anyone.

If you instead wanted to achieve a seven figure retirement in a condensed amount of time, all you need to do is increase the $5 a day to $10 or $20 and you’ll be able to nearly cut the amount of time required in half.

So What’s The Strategy?

The $5-a-day strategy is really simple. Every day you deposit $5 into your Roth IRA (I’d recommend doing one big $150 deposit once a month to save yourself time) and you invest the balance of your Roth IRA into low-cost S&P 500 index funds.

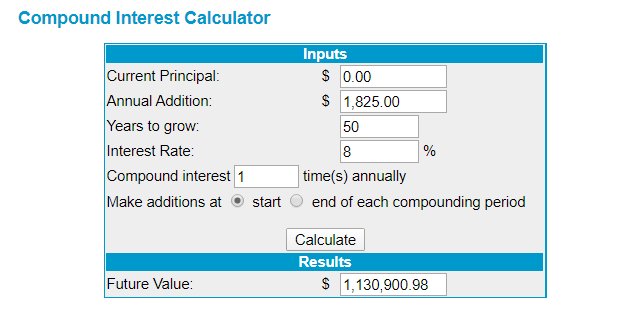

After a full year you would have deposited a full $1825 (365*$5) into your Roth IRA. Assuming an 8% rate of return, after 50 years you’ll have over $1.1 million in your Roth IRA awaiting your retirement.

Now for some of you, you might have what you need to go forward and start executing on this strategy. But there were a few terms and rates I mentioned above that could use some explaining.

First off, the S&P 500 is just a way of referring to 500 of the largest publicly-traded US companies.

Next, an index fund is an investment vehicle that is made up of a collection of different stocks that attempts to track an index.

An index fund is different from a mutual fund because a mutual fund attempts to outperform an index (like the S&P 500) while an index fund tries to mirror the index. This is one of the reasons why index funds typically have much lower fees than mutual funds.

Last, the reason for using 8% as the interest rate is because since 1926 the average return for the S&P 500 has been about 10%.

In order to make our calculations a bit more conservative I decided to assume a lower interest rate. When it comes to retirement I never want to play things too aggressive.

How To Open A Roth IRA

Ready to get started building tax-free wealth with a Roth IRA? If so, let’s make it happen!

To open a Roth IRA for free and get started today I’d recommend opening yours with M1 Finance. M1 Finance is a free investing app that lets you easily automate your investing whether you use the $5 a day strategy or not.

Personally, I have my M1 Finance account set up to withdraw automatically from my checking account every 2 weeks and deposit it straight into my investing account where it’s immediately invested. Doesn’t get much more passive than that!

To sign up for a free M1 Finance account click here and start taking the first step towards becoming a tax-free millionaire!